Stories

Whisky is a passion to explore. From the history of the spirit to the evolution of the industry, the story of whisky helps fuel that passion. Often, it’s easy to forget that whisky is also a global multibillion dollar industry. The stories of whisky — from news and new releases to in-depth inquires and what goes on behind the label — blend together to help us appreciate the spirit of whisky.

U.S. Tariff Trouble Hits Scotch Whisky Industry

February 7, 2020 – The United States has long been one of the Scotch Whisky industry’s most important markets, but the Trump Administration’s decision to target single malt whiskies from Scotland last October in a 15-year-long trade dispute with the European Union threatens to derail years of investment.

The U.S. imposed a 25% tariff on imports of single malt whiskies from Scotland and Northern Ireland October 18, along with other select European exports. The move came after the U.S. won its case at the World Trade Organization accusing Great Britain and other European companies of providing illegal subsidies to Airbus, and was allowed to impose tariffs on more than $7 billion worth of European goods to compensate for damage to the American economy.

The end result could be significant damage to the Scotch Whisky industry on both sides of the Atlantic. While blended whiskies not subject to the tariff still make up the majority of Scotch Whisky exports to the U.S., the share of single malt exports has been growing each year and accounted for around 25% of the industry’s exports to the U.S. in 2018.

Preliminary 2019 data will be released this coming week when the Distilled Spirits Council of the United States holds its annual economic briefing in New York City on Wednesday. However, Scotch Whisky Association CEO Karen Betts says the tariff has already had a significant impact based on data from October and November.

“The value of Scotch Whisky exports to the United States dropped 26% in October 2019 and 33% in November 2019 on the same period from the year before,” she said in a telephone interview. “It’s hard for us without looking at data over a period really to understand what the trends will be, but when we talk to the American spirits industry…now, American whiskey has a 29% drop in exports to the European Union since their tariffs came into effect (in June, 2018), so the figures we’re seeing I don’t think are very far off from what the ultimate impact might be, and we think we’re looking at £100 million ($129.5 million USD) in lost exports to the U.S. over a year,” Betts said.

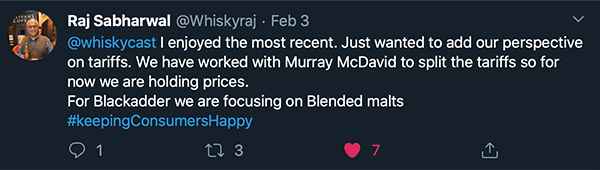

Diageo, Pernod Ricard, and other major Scotch Whisky producers have been able to withstand the impact of the tariff, largely because their Scotch Whisky portfolios are balanced between single malts and blended whiskies. As a result, smaller distillers and independent bottlers have been hit the hardest, and some have been forced to work with their U.S. importers to absorb the cost of the tariff in order to keep retail prices at pre-tariff levels. Islay’s Kilchoman Distillery and its U.S. importer, ImpEx Beverages, announced their plans to do so shortly after the imposition of the tariff. After our report on this issue during the February 2 episode of WhiskyCast, Glass Revolution Imports partner Raj Sabharwal tweeted new details on his company’s partnership with the independent bottlers Murray McDavid and Blackadder.

Other small distillers have not been as fortunate. Speyside Distillery has a $131,000 shipment of its Spey single malt sitting at the distillery after it was cancelled by American importer Quest Brands. Quest founder Ed Kohl told WhiskyCast in an exclusive interview that he was forced to cancel the order after the regional distributors he works with started scaling back on single malt Scotch inventories.

“They’re getting backed up from their retailers, the retailers are backing up and so are the restauranteurs…everybody’s backing up on this stuff because they don’t know what’s going on and they don’t know how long this thing’s going to last,” he said.

Speyside Distillers managing director Patricia Dillon is one of the many whisky industry executives reassessing their place in the American market because of the tariff. “When you’re a small company like us, you don’t have the biggest of margins, so if you have a 25 percent tariff…as a company, we’d have great difficulty absorbing that 25%, so long-term at the moment, we’re just trying to reposition ourselves and see what we’d have to do, because at the moment it would be very difficult for us to absorb that 25 percent,” she said.

Industry groups in both Scotland and the U.S. have been lobbying politicians to resolve their larger trade differences and end the whisky tariffs. Distilled Spirits Council CEO Chris Swonger led a joint delegation to meet with White House officials in mid-January to explain the economic hardships the tariffs have caused. In an interview, he said Trump Administration officials are well aware of those hardships, but are holding firm. “According to them, they’re playing long and they believe for national security purposes and a whole variety of purposes that they have to take an aggressive approach and an aggressive posture, and one of the tools they have in their tool belt is tariffs,” he said.

In fact, the Trump Administration is reaching for that tool belt once again. The Office of the U.S. Trade Representative has proposed to not only not remove the single malt whisky tariff, but potentially raise it to as high as 100 percent and apply it to more types of whiskies from throughout Europe. The latter proposal was originally floated last summer when the administration released a preliminary list of tariff targets in advance of the WTO Airbus ruling, but the final list was scaled back in the hopes that it would bring European Union officials back to negotiations over aircraft subsidies. The EU is waiting for a WTO ruling in a similar case against the U.S. over subsidies to Boeing, and has so far refused to negotiate.

A final decision on whether to expand the U.S. tariff could come at any point, and this week, Diageo emailed U.S. consumers in its “Friends of the Classic Malts” affinity group to urge them to speak out against the tariffs.

The email is part of an industry-wide “Toasts Not Tariffs” campaign led by Spirits United, a partnership between the Distilled Spirits Council and other industry groups that claims 17,000 supporters.

Importer Ed Kohl has nearly five decades of experience in the spirits business, and has seen prices rise and fall. He believes the industry can withstand the current tariff, but if the U.S. follows through on its threat, the industry could be damaged for years to come.

“Forget it, lights out…that’s it, it’s over…no way we’d be able to survive anything like that. Eventually at that point, even the big boys would have to raise prices,” he said, noting that at a whisky festival last weekend in Omaha, Nebraska, he saw consumers asking to taste rums and other spirits instead of whiskies because the tariff had raised whisky prices out of their range.

“This is very, very, very dangerous, because you’re talking about changing consumer trends,” Kohl said.

“Wow!”

Links: Scotch Whisky Association | Quest Brands | Speyside Distillers | Distilled Spirits Council | Spirits United