Stories

Whisky is a passion to explore. From the history of the spirit to the evolution of the industry, the story of whisky helps fuel that passion. Often, it’s easy to forget that whisky is also a global multibillion dollar industry. The stories of whisky — from news and new releases to in-depth inquires and what goes on behind the label — blend together to help us appreciate the spirit of whisky.

Support Grows For Extending Distillers’ Tax Break, But Still No Action

November 5, 2019 – There isn’t much that politicians on both sides of the aisle in Washington agree on these days., with one exception. There is bipartisan support in both the House and Senate for the tax break many U.S. craft distillers have relied on for the last two years, but which is scheduled to expire at midnight on New Year’s Eve unless Congress extends it. 315 House members and 73 Senators have now signed on as co-sponsors for the “Craft Beverage Modernization and Tax Reform Act,” according to updated totals released today by a group of spirits industry trade associations pushing for the extension.

That tax break reduced the federal excise tax distillers pay on the first 100,000 proof gallons of spirits they remove from bonded storage for sale each year from $13.50 per proof gallon to $2.70. While the nation’s major distillers can hit the annual limit within weeks, most craft distillers never come close to the threshold and the tax savings can have a major impact. For instance, a small-scale distiller who removes 10,000 proof gallons from bond during 2019 would owe the federal government $27,000 in excise taxes under current law. If the tax break is not passed, the 2020 tax bill for the same amount would be $135,000.

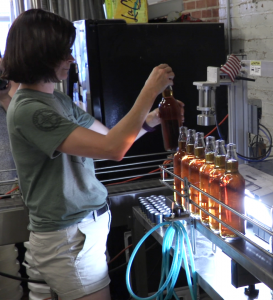

“When they went down, we hired people, and you know, we’re going to have to look at our budgets and tighten our belts…it’s going to be a really big deal,” says Scott Harris of Catoctin Creek Distilling in Purcellville, Virginia. Scott and Becky Harris opened their small distillery ten years ago to make rye whiskey and other spirits, but have been forced to spend almost as much time focusing on politics as they have on distilling.

The tax break has saved them nearly $80,000 in federal excise taxes in 2018 and 2019, even though they never get close to the threshold where the regular tax rate would kick in. Becky Harris says there are many misconceptions about the tax break on Capitol Hill, despite the significant level of general support for extending it.

“So many of our representatives don’t know that we have never had a tiered system like beer and wine have for the federal excise tax. They were under the impression that this would just basically bring us back to being tiered, and we’re like, no…essentially, this brings us back to paying exactly what Jim Beam and Heaven Hill pay,” she said. Historically, brewers and winemakers have had a tiered system of excise tax rates tied to their annual production. However, the excise tax for distilled spirits had always been a single rate until the current reduction was approved in tax legislation at the end of 2017.

Both the House and Senate are essentially on recess this week with no votes scheduled, and the bill to make the tax cut permanent has been languishing since last February in the House Committee on Ways and Means and the Senate Finance Committee. Even though there is bipartisan support for that bill, the challenge remains finding a place for it on the crowded Congressional agenda – especially with a November 21 deadline to pass budget legislation in time to avoid another federal government shutdown.

“We’re told that if there is a vehicle, that we will almost certainly be in it, but one of the big questions right now is will there be a tax extender package or a vehicle for us to ride across the finish before the end of the year,” says Mark Shilling of Revolution Spirits in Austin, Texas. Shilling is a former president of the American Craft Spirits Association and has been active on the excise tax issue for many years. “We are part of a large universe of folks who have temporary tax provisions that need to be reauthorized, so it’s not just us out there saying ‘hey, hey, look at us – we’ve got this thing and it’s really going to hurt if we don’t get an extension,'” he said.

Distillers started lobbying to make the tax cut permanent as soon as the temporary cut took effect, and Becky Harris has been pushing Virginia Senators Tim Kaine and Mark Warner to join the list of co-sponsors. “Senator Kaine just had a roundtable talking about the rural economy, and I know he’s a fan of our whiskey…I was bending his ear on it just a couple of weeks ago,” she said.

The Harrises also had another chance to lean on Senator Kaine. Scott Harris personally delivered several bottles of Catoctin Creek Rye to Kaine’s office at the Senator’s request last week to help them celebrate the Washington Nationals World Series championship. We have asked Sen. Kaine’s office for his position on the extension, and will update this story when we receive a response.

Links: Catoctin Creek Distilling | Revolution Spirits | American Craft Spirits Association